Table of Contents

Economy and financing of efficiency: new buildings, renovation and step by step retrofit

Introduction

The economic assessment of buildings has to be based on life cycle costs. From the beginning this was the concept of the Passive House, and the concept of cost optimality (“cost optimal level”) based on life cycle costs has become a major issue in the Energy Performance of Buildings Directive (EPBD) of the European Union.

There are many methodological frameworks that fit more or less in this scheme: not all methods though fulfil the requirement of reflecting the whole economic picture. Furthermore, boundary conditions are as important as the method. Inadequate methods, different assumptions or boundary conditions are the most important cause of extremely different results of empiric studies. The main sources of major distortions are assignment of costs that are not related to energy efficiency, underestimation of life expectancy, failure to consider residual values at the end of the calculation period, unrealistic assumptions on energy price increases, unreliable design and quality of measures, inadequate expectations on return and related discount rates, and lock-in effects. The net effect of these influences is usually that estimated economic energy savings result much lower than they are, which turns out to be a strong barrier for the implementation of energy efficiency.

Economic Assessment of Energy Efficiency

The overall longevity of buildings implies that short payback periods cannot be expected; they are not good indicators since they are neither related to the investment period length, nor to the relevance of the measures. Instead, the whole life cycle as well as the interests must be regarded. This view is implemented in dynamical methods based on present values. In theory, economic activities aim at profits which can only be valuated in comparison with alternatives. The alternative to an energy efficiency investment is the investment in other assets or a bank deposit which yields interests. Another option would be to avoid the loan, thus saving interests on debt. .

Costs

Expenditures are made to achieve benefits. However, these investments have follow-up operational costs, e.g. for maintenance and energy. The end of the building useful life in most cases is not planned as it will happen in the far future. It is not even known whether costs or revenues will occur at demolition. Therefore, life cycle costs of buildings mostly include the investment cost and estimated running costs, referring to the same point in time. Life cycle costs are the total costs over the building life time, discounted according to the year when they occur.

Investment theory

Benefits become market goods, and investments are made to achieve revenues from benefits sold on the market. The goal of the investor is to achieve an economic advantage: an investment should be at least as attractive as its alternatives that are available on the capital market. Surpluses are gains, when they are higher than those for an alternative, economically comparable, capital asset. The benchmark is the return for comparable assets (classification: risk; a subjective assessment can involve non-economic factors too). In a perfect capital market there is only one interest rate (= price of capital). Investments should be profitable on the long run.

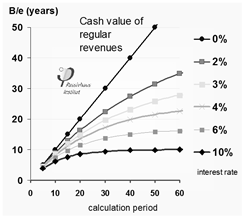

The present value of revenue (or any cash flow) is the amount needed now to yield the same revenue from the bank, including interests. The present value of a payment is the amount you need ‘now’ to pay ‘later’, when the expenditure occurs. Since present values refer to the same point in time, all receipts and expenditures become comparable, but the result depends on the discount rate. Discount rates are crucial: High expected rates of return depreciate later revenues, thus the upfront investments. Therefore, the choice of an adequate interest rate is important. For effective economic assessments, it is useful to do the calculation based on real prices and interest rates, while inflation - which does not affect the economic result - is taken out from the calculation.

The net present value (NPV) is the sum of all present values: costs (or payments, e.g. the investment) are negative, and revenues are positive. The NPV is the total gain of the investment, when all lifetime costs and revenues are taken into account. Therefore, a positive or non-negative NPV means that the investment is economic. As long as capital (incl. debt) is available, it is economically profitable to make any investment up to a NPV of 0.

Besides the net present value, other target values and methods are used. While our main focus is on the investment’s object, investors may have a different point of view (equity perspective). Instruments like the Discounted Cash Flow (DCF) (based on the same discounting principle of the present value method) or the Visualization of Financial Impli-cations (VoFI's) methods are used to optimise financing (equity or debt capital) or taxation aspects. In VoFI's all in- and out-payments (i.e. original payments that are not discounted) imputable to an investment are reported for individual periods. This includes all funding as well as interests and tax payments; the method is especially used for liquidity planning.

Methods, boundary conditions, possible distortions

As long as boundary conditions and perspectives are the same, the above mentioned dynamical methods lead to the same economic result. But it turns out that this result is very sensitive to the assumptions about boundary conditions. Therefore, it is very important to survey boundary data very carefully. Special attention has to be paid to all estimations of future data, in case of doubt sensitivity analyses shed light on the possible range of results. Otherwise, the economic assessment may be severely distorted. In particular, it is necessary to verify:

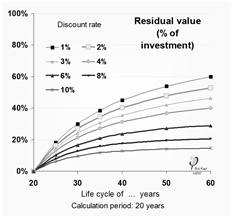

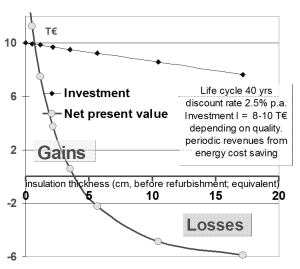

| Figure 2: Residual values for calculation period of 20 years | Figure 3: The economical effect of bringing forward the exchange of windows (2013)with Passive House windows | Figure 4: Medium quality is a barrier to future energy efficiency investments. Here: Wall insulation, profit depending on insulation thickness equivalent before refurbishment. |

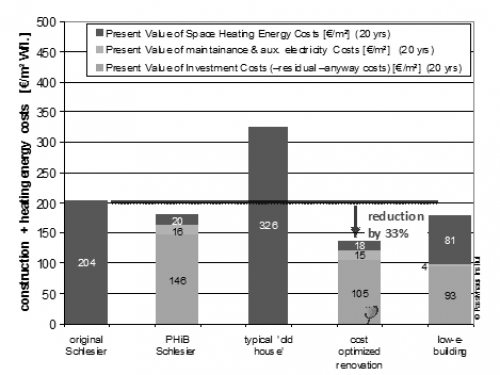

- Proper attribution of investment costs: only (additional) investments that are imputable to energy efficiency may be accounted for in the economic analysis. Although this seems obvious, the calculation including all the measures’ costs which are often many times higher than the additional investment costs for energy efficiency, is very often the reason for a wrong economic assessment result.

- Life cycle of the measures: make sure that revenues (e.g. saved energy’s costs) yielded after the end of the pay back time are not forgotten. Total life cycle results are what counts.

- When calculation periods are longer than the life cycle of the measure or the component, replacement costs must be considered. However, when they are shorter (which is often the case for buildings), residual values must be regarded at the end of the calculation period – instead they are often forgotten. Depending on the lifetime span, the calculation period and the discount rate, residual values can easily be up to 30% or more of the original investment.

- Interest (discount) rates: often the expected rates of return are inadequately high (see next chapter)

- Future energy prices and price increase: Assumptions on constant rate of growth may lead to unrealistically high energy prices for long calculation periods.

- Point in time of the measure: does the measure fit within the normal renewal cycle, or is there a residual depreciation of the component? In the latter case, the residual value of the basic investment has to be added to the extra energy efficiency investment. This proves that undertaking retrofit based on potential energy savings is not an effective strategy

- The starting point of energy efficiency interventions: medium quality reduces energy demand, but also possible energy savings later, thus the potential revenues of an energy efficiency investment. Future amendments to improve their quality are very improbable because they will not pay back, thus impeding future sustainable developments. Therefore, “when you do it, do it right”.

Risk and return

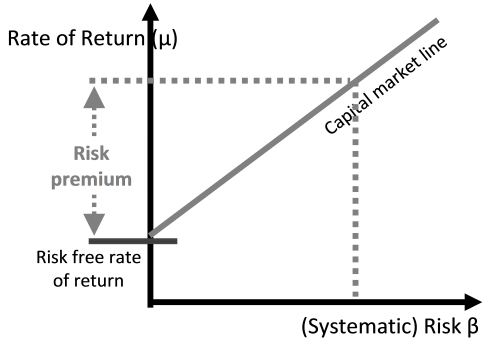

One of the most prominent distortions results from the frequent expectation of high returns.

The expected rates of return are the calculatory interest rates (or discount rates) in the dynamic economic assessment. We have seen that the present value of future payments decreases with high interest rates and depreciates the investment. But high interest rates are coupled with high risks. On the capital market, it is not possible to earn high interests with risk free investments. However, energy saving investments are risk free or even risk reducing - as long as the building they belong to are not in question. Which buildings should be kept in the stock and upgraded is a decision concerning the real estate portfolio management. However, once the decision to proceed with the retrofit has been made, it is always advantageous to include the energy efficiency investment, reducing the risk of higher energy prices that might affect the market. Since risky investments with the chance of higher ROI's are not comparable with energy efficiency investments, they are not eligible alternative assets to measure the economic success. For low risk investments, however, a “risk premium” cannot be expected. They can be financed by credits though, and they should when equity is expected to yield high rates of return.

Cost optimality

The European EPBD aims at the implementation of “nearly zero energy buildings”. The economic criterion beyond the directive is the reference to life cycle costs for both new and retrofitted buildings. Economy is assessed solely on the basis of life cycle costs. The minimum requirements to be defined by the member states have to meet the 'cost optimal level' which is supposed to move in the direction of higher efficiency after the effects of learning and scale; member states are expected to support this development. It has been shown that Passive House components allow achieving profitable levels and given PH low energy demand, the basis for the supply with renewables from nearby. This is the background of “Passive House Regions” [PassREg].

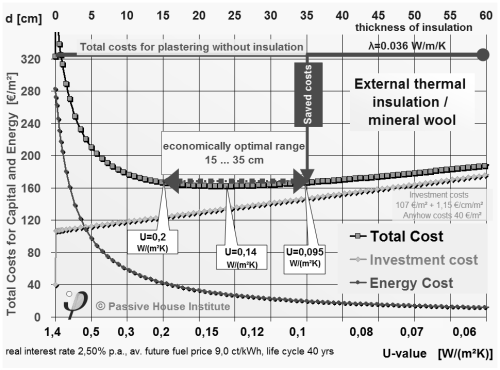

| Figure 6: Life cycle costs for external insulation (refurbishment) depending on insulation thickness. The cost optimal range is in the range of EnerPHit Standard. |

It is important to tap the full potential of profit -at least up to the cost optimal level. Otherwise it would become very difficult to mobilise the rest of the potential, as measures’ minimum costs would be too high to be paid back within the life time. The cost optimality curves are usually very flat; therefore very low additional efficiency investments fall within the uncertainty range with respect to cost optimality. Neverthe-less they are a risk reducing and cheap insurance against energy shortage and price rises. It is important to note that, as discussed before, the rate of return is an interest rate for risk free investments, and, obviously, is not the target value for optimisation.

Even Passive House components for renovation projects are economically optimal, when evaluated on the basis of correct life cycle costs (see ). For such renovations, PHI has established the “EnerPHit” label. Depending mainly on the building conditions before refurbishment, there might be a high economic gain leading to an extremely good rate of return with a low risk investment. It is hard to find anything that could provide a similar economic advantage.

Documented projects

A solid basis for all cost evaluations are well documented retrofit projects, including achieved savings and thorough analysis of the investment costs for all building components. A main issue though, is to separate extra costs for energy efficiency from usual retrofit investment costs.

These costs arise anyhow for different reasons - normally due to damaged components to be changed or repaired. This is the point in time when energy upgrade is possible with just little extra investment usually paid back by the saved energy costs. On the other hand, nobody would expect total renovation costs to be financed by saved energy costs. Therefore, in most cases it is not reasonable to renovate with the sole goal of energy savings. For economic calculations, the exact attribution of investment costs is essential. Built projects provide evidence in support of data used for the calculations. A research project was undertaken by the research group on cost effective Passive Houses, to analyse all construction steps of built projects, including thorough cost documentation, discussion of methods, life cycle analysis and conclusions. [AkkP 42]. An example is shown in.

The results may differ according to the location, as climatic conditions are different and so are the cost optimal levels of components and their U value requirements etc. PHI analysed this relation in detail in a worldwide study [Schnieders et al., 2012], concluding that this principle always leads to a very low energy demand. Distortions occur due to too low energy prices (e.g. subsidized), high initial costs of components (which might not yet be locally produced or are still new on the local market) or due to inadequate assumptions as mentioned above. After learning effects the results will be similar to those of countries with longer tradition in energy efficiency.

EuroPHit: Step by Step

The EuroPhit project - supported by the EU within the Intelligent Energy Europe framework, focuses on step by step retrofit. This part of the renovation market is often not perceived, although it has a considerable share. Step by step retrofit is not an exception but normal practice: renovations are done when there is a cause for that, and we have seen that this is reasonable also from the economical point of view. Furthermore, owners tend to avoid big renovations when possible. It is also true that partial renovation cannot be adjusted or completed later, without extra effort that would not pay back. The opportunity can be taken or not.

EuroPhit will show how high quality - guaranteed by integrated design, trained workmanship, and collaboration of all actors in built projects all over Europe -, will lead to reliable performance, including the achievement of efficiency goals and economic results, even for well-planned step by step retrofit. For correct economic analysis, it is crucial that the planned energy savings are realized, as they define the revenues. Step by step renovations differ, in that each step should be completed in view of the final high efficiency result. From the economic point of view, it is advantageous when all components are upgraded at the end of their lifetime. However, analysis has to take into account the extra costs for any work to be repeated during following renovation steps, and compare them with the additional costs of doing the next step’s interventions in advance.

Financing and effective incentives

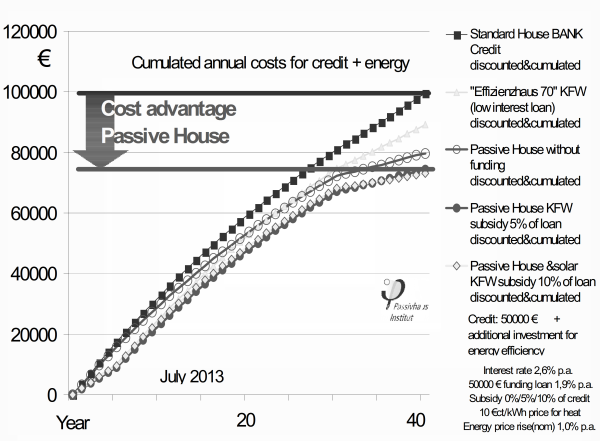

All investments have to be financed. In the building sector, large capitals are needed, which in many cases cannot be covered by equity. Therefore, often credits are needed, with more or less attractive boundary conditions and required collaterals. On the other hand, credits required for partial renovations are smaller, and seem not be particularly relevant for banks, so they don't offer attractive conditions. The picture might change if a long term plan for step by step retrofit would be set up, including high quality design and coordination of the whole process. In this case, the owners can offer excellent collaterals and the credit represents a low risk for the financing institution, thus it can be awarded at good conditions and/or good ratings.

Funding and incentives help overcome financial barriers. When the investment is not economical on the basis of life cycle costs (e.g. in markets that are new to energy efficiency), a subsidy can make it economically feasible. This situation can be used to influence the market in an effective way: Incentives should aim at supporting an effective and sustainable reduction of energy demand and carbon emissions, and to guarantee a good performance by quality assurance requirements.

If energy saving investments are already economically feasible, funding should avoid keeping them expensive. Instead, financial aids should focus on:

- improving liquidity and reducing the financial burden. This can be achieved through direct financial support, but also special credit lines with low interest rates (especially in the first years)

- supporting collaterals to facilitate access to attractive bank credits

- binding financial support to quality assured design to realize the expected performance and guarantee damage-free construction and long lifetime measures

- achieving very high energy efficiency, because the next renovation will only happen after many years. In this respect, medium quality would hinder the necessary reduction of energy demand and emissions and cause a “lock in” effect.

- An interesting example is offered by the German KfW credits (www.kfw.de). The low interest loans for energy efficient new and retrofit buildings are coupled with direct subsidies, which are higher for better energy efficiency.

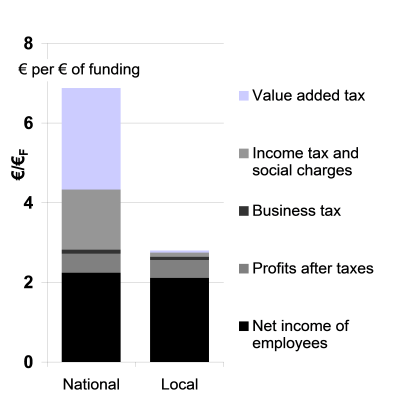

- Many German regions provide extra subsidies in support of energy efficiency. For the Hanover region e.g., it could be proved that every Euro granted by the proKlima-Fonds:

generates a total investment of 16 €, while the additional investment for additional efficiency is only 2 € (but double the value of the incentive)

creates added value of 7 €

generates a local labour equivalent to 3 €.

Therefore, funding is not only beneficial for the investor and the building owner, but also for the community. This is because it does not just generate otherwise unneeded labour, but also is multiplied by private investments which create real added value. This is also true when the incentive is not necessary for the profitability of the investment, but “only” for better boundary conditions of financing, or for raising awareness. Furthermore, this process implies other positive economic effects that are not included in the above results, especially the better quality and longer lifetime of the buildings and all the effects of learning and scale.

References

[AKKP 08] W. Feist, Article of Research group on cost effective Passive houses 08 “Material selection, ecology and indoor air hygiene Life-cycle energy analysis: Comparison of low-energy house, Passive House, self-sufficient House, Darmstadt 1997 (in German).

[AKKP 42] Proceedings of Research group on cost effective Passive houses 42 “Economic assessment of energy efficiency measures”. Passive House Institute, Darmstadt 2013 (in German).

[AKKP 39] Proceedings of Research group on cost effective Passive houses 39 “Step by step renovation with Passive house Components”. Passive House Institute, Darmstadt 2009 (in German).

[EuroPHit] "Improving the energy performance of step-by-step refurbishment". Intelligent Energy Europe, 2013 - 2016. www.europhit.eu

[Kah et al., 2008] O. Kah; W. Feist; et al: Bewertung energetischer Anforderungen im Lichte steigender Energiepreise für die EnEV und die KfW-Förderung; Studie im Auftrag des BBR, Darmstadt 2008

[Passipedia] The Passive House knowledge data base. Central parts of research published in German have been translated and are available online on www.passipedia.org

[PassREg] Passive House Regions - Passive Houses with Renewable Energy. Intelligent Energy Europe, 2012 - 2015. www.passreg.eu

[Schnieders et al., 2012] Schnieders, J.; Feist, W. et al: “Passive Houses for Different Climate Zones”. Passive House Institute. Darmstadt, May 2012

| The sole responsibility for the content of Passipedia lies with the authors. While certain marked articles have been created with the support of the EU, they do not necessarily reflect the opinion of the European Union; Neither the EACI nor the European Commission are responsible for any use that may be made of the information contained therein. |